Pro

-

- Login Marketing after login

Should Churches (Including Mosques, Synagogues, etc.) remain Tax-Exempt?

- K Kai

- 2020.03.09

- Comments.0

- SNS Inflows.1

- Shares.0

- Views.1922

US churches* received an official federal income tax exemption in 1894, and they have been unofficially tax-exempt since the country’s founding. All 50 US states and the District of Columbia exempt churches from paying property tax. Donations to churches are tax-deductible. The debate continues over whether or not these tax benefits should be retained.

- Comment

- Survey

- NPS

- Share

- Subscribe

- Unsubscribe

- Analysis

Exempting churches from taxation upholds the separation of church and state embodied by the Establishment Clause of the First Amendment of the US Constitution. The US Supreme Court, in a majority opinion written by Chief Justice Warren E. Burger in Walz v. Tax Commission of the City of New York, decided May 4, 1970, stated: "The exemption creates only a minimal and remote involvement between church and state, and far less than taxation of churches. It restricts the fiscal relationship between church and state, and tends to complement and reinforce the desired separation insulating each from the other." from https://churchesandtaxes.procon.org/

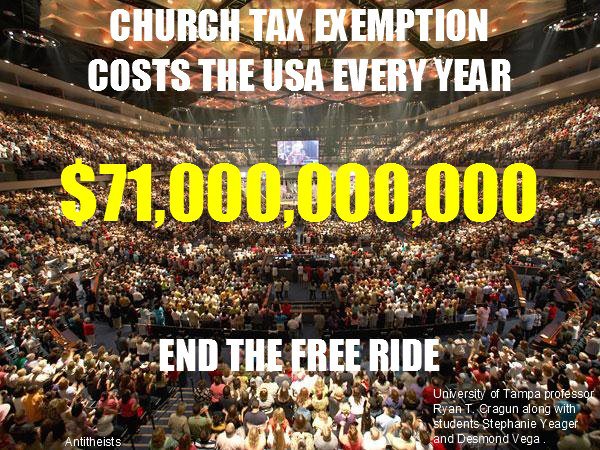

Cons

Tax exemptions for churches violate the separation of church and state enshrined in the Establishment Clause of the First Amendment of the US Constitution. By providing a financial benefit to religious institutions, government is supporting religion. Associate Justice of the US Supreme court, William O. Douglas, in his dissenting opinion in Walz v. Tax Commission of the City of New York, decided May 4, 1970, stated: "If believers are entitled to public financial support, so are nonbelievers. A believer and nonbeliever under the present law are treated differently because of the articles of their faith… I conclude that this tax exemption is unconstitutional." from https://churchesandtaxes.procon.org/

Net Promoter Score(NPS) Assessment

How likely is it that you would recommend this product/service to a friend or colleague ?

What are the primary reason you gave us that score ?

Net Promoter Score (NPS)

It is expressed as a percentage from a maximum of 100% to a minimum of -100%, and a percentage lower than 0 means that there are more detractors than promoters.

- Comment

- Survey

- NPS

- Share

- Subscribe

- Unsubscribe

- Analysis